[ScaleUp Blueprint] Prioritizing what’s important when entering a new market or segment

Entering a new market or segment is the most common “seismic shift” we are asked about in advisory at Insight. As companies experience success in a given market, they naturally want to expand into new countries or segments to further accelerate growth. But as you move into a new market or segment, you can’t assume that duplicating your original approach will yield the same results.

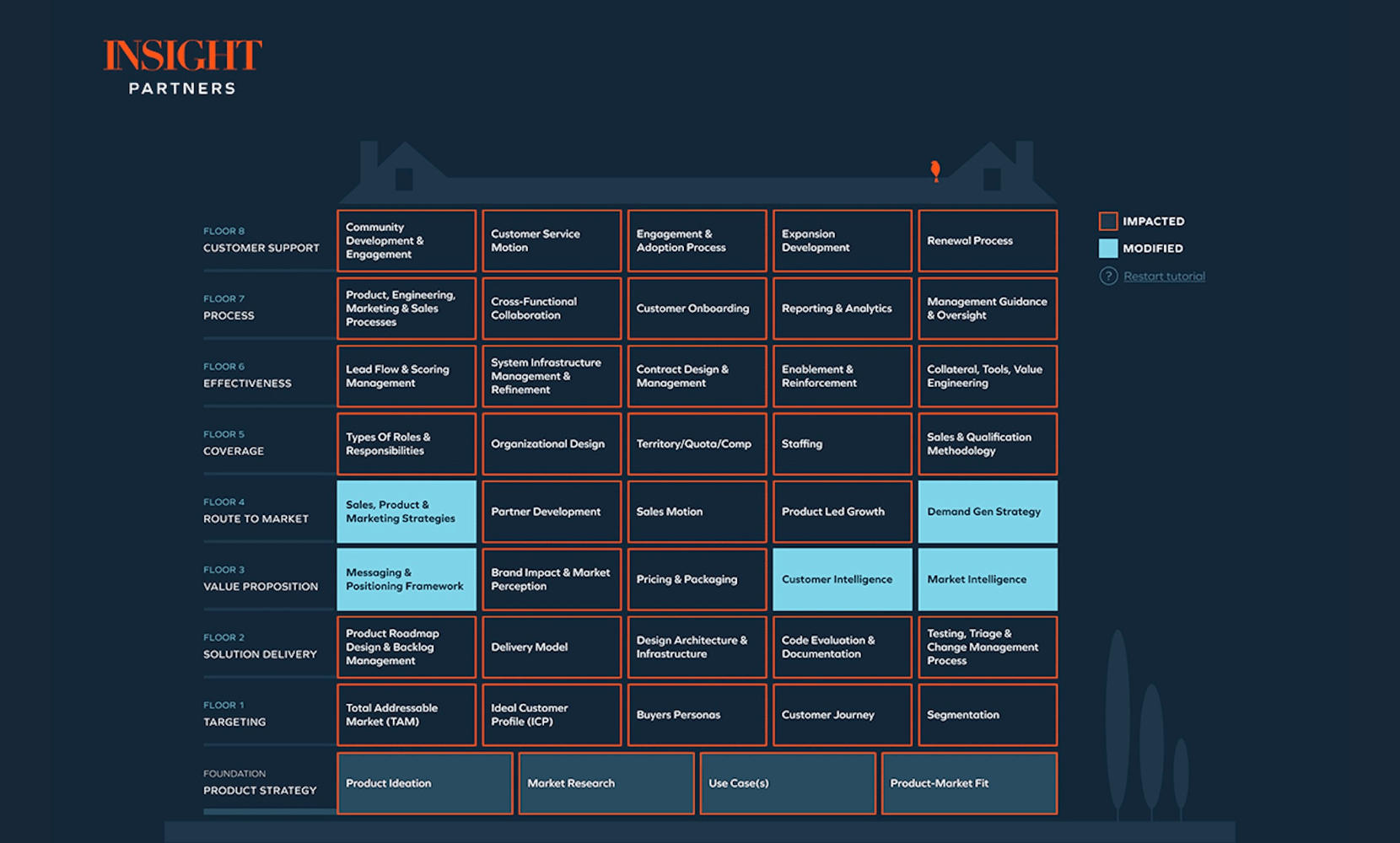

Last fall we introduced Insight’s proprietary SaaS Growth Acceleration Framework as a comprehensive blueprint for go-to-market (GTM) success, leveraging our extensive, nearly 30-year history of fostering successful growth for SaaS companies.

Aimed to help driven growth-stage ($10M+ ARR) companies prioritize and align GTM strategies — across product, technology, marketing, sales, and customer success — the framework also helps leaders understand the downstream implications of modifying any single component of their GTM strategy, and meaningfully scale their business.

This series of three articles accompanies our new interactive framework and illustrates the deeper implications of some of the most commonly encountered “seismic events” leaders ask our advisory group. These are critical events in any ScaleUp’s journey that shake the foundation and fall outside of the typical business blueprint for growth:

- Entering a new market or segment

- Navigating mergers and acquisitions

- Launching a new product

As ScaleUps recover from external forces that have shaped the Great Reset and approach a path toward efficient growth, many are turning to their advisors and investors to help tackle factors that are in their control. By focusing on the right GTM components, founders and CEOs can address most of the issues that could derail their company’s growth at those pivotal moments.

![[ScaleUp Blueprint] Prioritizing what's important when entering a new market or segment](gif/flow-1-1.gif)

Seismic shift: Entering a new market or segment

At a minimum, you should review and potentially modify these five elements:

- Market Intelligence

- Customer Intelligence

- Messaging and Positioning

- Sales, Product, and Marketing Strategies

- Demand Generation

Market Intelligence

What is it?

Market intelligence is the proactive process of collecting and analyzing data to understand competitors, industry trends, and changes to the customer landscape. It helps you make decisions about product adjustments and marketing and sales strategies.

Who is responsible: Product Marketing (owner), Marketing (consulted), and Product (consulted).

Questions to ask

- Do you have a clear perspective on my competitors? What are their strengths/weaknesses?

- What are your competitors’ product gaps, and how can you highlight/exploit them?

- How loyal are your competitors’ customers? What do they value most from the competitor?

- How does your product stack up against competitors’ solutions?

Our advice

Before entering a new market or segment, you should have a comprehensive view of that market. You need to understand who the key competitors are, the strength of their products, and the pricing mechanisms used in that market. You also need to understand local regulations that could impact your business. There have been instances where a company entered a market only to find that regulations required that they host their solution locally and adjust the data collected, leading to significant product investments. By understanding the market, you can make the necessary adjustments to the other areas of the framework.

Customer Intelligence

What is it?

You need to collect and analyze data from prospects and customers to understand their needs, improve your interactions, deliver personalized experiences, and refine your sales and marketing strategies.

Who is responsible: Product Marketing (owner), Marketing (consulted), and Product (consulted).

Questions to ask

- Do you understand your customers’ needs and motivations?

- What problems are customers solving with these products?

- How much are customers willing to spend on similar products in the market?

Our advice

A customer in the U.S. may have different buying behaviors than one in Europe, Asia, or Africa. These different buying behaviors are even more pronounced when moving between segments. A customer in a small business may be the sole decision maker and may only have one or two trusted advisors; this means that they tend to make decisions quickly and are much more sensitive to pricing.

A large, multinational company typically has six to eight interested parties internally and various external advisors. A company that shifts from SMB to Enterprise will find that the buying process requires changes to their staffing models, demand generation efforts, and sales motion. Your marketing and sales efforts can fall flat without understanding the buyer’s behaviors and how their needs change in different market segments.

Messaging and Positioning

What is it?

A framework that defines the key elements of your messaging and positioning, including your unique value proposition, your target audience, and how you differentiate from competitors.

Who is responsible: Product Marketing (owner), Marketing (consulted), and Product (consulted).

Questions to ask

- Do you have a defined messaging and positioning framework for this product?

- Does the value proposition statement include the solution’s key differentiators and core benefits?

- Is your messaging and positioning consistent with the higher-level benefits your company delivers to its customers?

- Has sales leadership reviewed the value proposition and agreed that it is clear and aligns with market expectations?

Our advice

Given the potential differences in buyers and their buying process, revisiting your messaging and positioning is essential. It will inform your marketing content creation, sales pitches, and GTM training — and be reinforced in your customer training. Good messaging highlights how your solution addresses this market’s unique needs while highlighting how you’ve helped companies in your core market.

Sales, Product, and Marketing Strategies

What is it?

What is the strategy for each of the GTM elements? How will you drive growth, protect your current customer base, etc.? This can include many of the route-to-market components in our blueprint.

Questions to ask

- What channels will distribute this offering? (i.e. Direct, Indirect, PLG?)

- Do you have clarity on which segments of the market each group will target?

- What logistics and operations are necessary to get the product to the end customer?

- What approach will we use to drive awareness of the solution in the market?

Our advice

The environment you’ll be selling into may differ greatly from your core market. You need to consider whether you’ll use a product- or sales-led motion and, if you’re going SLG, how you’ll use channels versus direct sales. From a marketing perspective, you need to rethink how you drive awareness and cultivate leads. Product is also impacted, as you’ll need to adjust based on the regulatory and competitive landscape. Revisiting your strategies will guarantee you hit the ground running when entering the market.

Demand Generation

What is it?

Demand generation is the tactics used to generate demand for a product, including lead generation and nurturing to drive brand awareness and revenue growth.

Who is responsible: Marketing (owner), Product Marketing (consulted), and Sales (consulted).

Questions to ask

- Have you determined the demand gen tactics you plan to deploy when launching this product? How are they aligned with your reach, ICP, and target markets?

- Do you know which channels will drive top performance?

Our advice

Demand Generation is one of the most impactful — yet often overlooked — areas of entering a new market or segment. We have seen numerous companies enter markets by staffing up a sales and BDR team to do outbound calling, not realizing that the market is unaware of them and that the sales and BDR teams would be evangelizing the product and the need for the product. Rather than take this approach, we encourage companies to first invest in awareness efforts and demand generation. This allows you to give the sales reps warm leads they can convert while they begin outbounding.

Scale up like an expert

These five elements have proven to be key areas to review before entering a new market. That doesn’t mean that there won’t be other components that you need to address. We recommend that you review each element of the framework, but if you get these five things right, it should put your company on a path toward a successful market launch.

Explore the interactive SaaS Growth Acceleration Framework here.