[ScaleUp Blueprint] Launching a new SaaS product

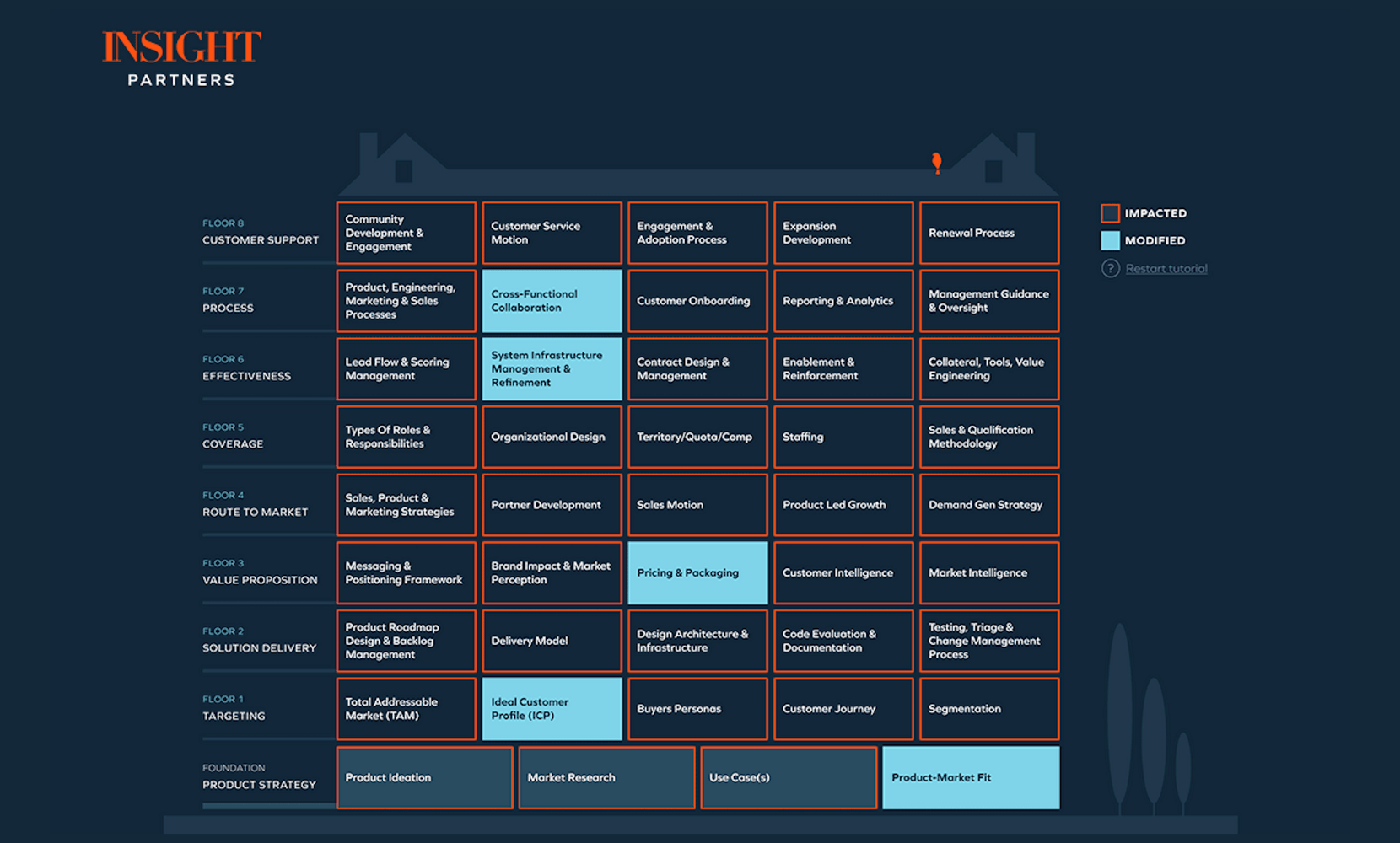

Whether you’re launching in a new market or segment, acquiring a new company, or launching your next new product, leaders in growth-stage ($10M+) SaaS companies can use our new, interactive Growth Acceleration Framework to navigate 40+ critical business decisions.

The elements that we have detailed are the ones that are most commonly at risk during each of these major company-changing events. By using the framework, you can prioritize the specific elements that will need focus in order to be successful in these “seismic” shifts.

A seismic event is something that happens in a company’s lifecycle that has a profound impact on its path forward. It’s an event that shakes the very foundation of a company. At Insight, we believe three key seismic shifts are within the control of the company:

- Entering a new market or segment

- Navigating mergers and acquisitions

- Launching a new product

Below, let’s explore the critical business decisions for launching a new software product.

Seismic shift: Launching a new product

Launching a new product does not refer to a minor product update or even a major update to an established product, but the launch of a completely new product that may be complementary to the existing product. Typically, companies shift from single-product to multi-product when they have a significant base of established, happy, and renewing customers. Going multi-product allows companies to scale significantly faster because it allows for significantly higher NRR through cross-selling multiple products.

The effort to launch a new product bears similarities to the launch of a new company as it starts at the initial product ideation, establishing product market fit, and then building the brand and positioning in the market. Because of the significant cost associated with building new products and the complexity of a successful launch, it is important to assess all of the different elements of the framework. While all of the elements are important, there are a few that we consistently see posing challenges to the success of a product launch:

- Product-Market Fit

- Ideal Customer Profile

- Pricing and Packaging

- System Infrastructure Management and Refinement

- Cross-Functional Collaboration

Product-Market Fit

Our advice

Before moving on to the later stages of the product launch process, product-market fit (PMF) must be firmly established. However, especially when a company is launching their second product, the team may assume that they understand the market and customer base and skip the process of confirming product market fit.

Without firm proof that there is a definite market willing to pay for the solution, the company may waste GTM resources and scale too quickly only to find that the market doesn’t exist. Leadership must validate that the PMF evaluation is complete and comprehensive before further investing. This is even more important when the product is being sold to a new market in which the company has modest experience.

Ideal Customer Profile

What is it?

Ideal Customer Profile identifies attributes of the most valuable accounts to target so companies can better attract, engage, close, and retain business.

Who is responsible: Product (owner), Sales (consulted), and Marketing (consulted).

Questions to ask

- Do you have defined ICPs containing firmographic, environmental, and behavioral attributes?

- Has your ICP been validated by quantitative research, including some or all of the following data sources:

- Win/Loss Data

- Customer insights

- NPS

- Has your ICP been tested in the market to ensure you are targeting the right customers and delivering a product that meets their specific needs? Or will you be testing through the product launch?

Our advice

Although, in most cases, the product is being sold to the same basic market as the original product, we can’t assume that the customer is identical to that of the original product. What needs does the product address, and which customers have similar needs? Are there nuances to the types of customers that need this solution — for example, are there specific industries where the needs are more pronounced? Are there technologies that must be in place before this solution can be used? Once you’ve evaluated and identified these specific descriptive elements, is the ICP large enough that expending resources to launch the product makes sense?

Pricing and Packaging

What is it?

Your pricing and packaging model defines how you align the price you charge to the value you deliver. It is a SaaS company’s most efficient profit lever, requiring cross-functional alignment to execute correctly.

Who is responsible: Product (owner), Finance (consulted), and Sales (consulted).

Questions to ask

- Do you understand your top competitors’ pricing strategies and where you can differentiate?

- Do you understand how you want to charge for your product? Which pricing metric aligns with the product’s perceived value, scales over time to drive revenue growth, and is measurable and billable?

- Do you know how much customers will pay for this product, or how much value it delivers? Does this vary by customer segment?

- Do you know how to create a balance between exposing the value of this product and monetizing it to drive upsell/cross-sell?

Our advice

It is tempting to price the new product using a similar structure to an existing solution, but launching a new product allows a company to reassess their overall pricing and packaging strategy. What pricing construct should you use: per seat, usage-based, or a hybrid model? Do customers see inherent value in buying both solutions — if so, you should look at bundling the two products together. Given that this is a new product and you may not have built a scalable implementation process, will the prices being offered drive significant new business and potentially impact your ability to deliver high-quality implementations? Conducting a pricing study helps to uncover the optimal price points and packaging to optimize sales and profitability.

System Infrastructure Management and Refinement

What is it?

This refers to the necessary changes to internal monitoring systems, such as analytics, traffic, product administration, billing, etc. This will allow you to gather enough information to refine the product, helping to improve customer experience and sales.

Who is responsible: Tech (owner), Legal (consulted), and Product (consulted).

Questions to ask

- What are the technical constraints that the system infrastructure needs to accommodate?

- Are there any regulatory requirements or standards that must be met?

- How will the infrastructure track customer usage and satisfaction?

- How will the infrastructure track product performance?

Our advice

Most companies launching their next product have achieved a certain level of scale and have therefore invested in technology to support automated reporting, billing, and renewals. Unless the company had the forethought to design those systems for future products, they will likely need to be updated, and processes may need to be rethought if they launch an additional product.

You should also think through the following:

- Do you have the ability to add new SKUs?

- Is the pricing structure able to be reworked to accommodate a second product?

- How will you handle billing and contracts where a new product is added part-way through the contract but where the customer wants to have the products co-term?

- Do you need to build different sales processes into Salesforce to accommodate unique sales motions?

- Are there channel requirements in the system design that need to be rethought?

It is important to evaluate your solutions and determine any needed fixes before launching the solution. These changes can be made during the product launch process but may impact visibility.

Cross-Functional Collaboration

What is it?

Team Alignment on strategic goals is key to a successful outcome. But it’s more than just goal alignment. It’s also the collaboration and execution of those goals.

Questions to ask

- Do your teams have goals that are aligned and complementary?

- Do your compensation plans (goals-based bonuses) create conflict between the teams?

- Are your teams consistently meeting to discuss modifications to the product or GTM approach?

Our advice

New products impact every organization in a company, but they can be launched in silos. Product may be building out a solution that they believe will be a hit in the market, but all too often, they fail to engage marketing to complete a market study or even a customer advisory group session. Marketing may be working on amazing messaging that aligns perfectly with the buying process and customer needs, but it will fall flat if they don’t get it to sales in time to train the team on how to deliver it.

And sales may have developed a plan to target prospects in a highly tailored way, but, if they haven’t communicated that to customer success, the customers will get standardized experiences. None of the teams can be successful working in a silo. It takes management engagement and a concerted effort to align the teams around the common goal of launching the product and ongoing communication to keep them all connected.

Scale up like an expert

Explore the interactive SaaS Growth Acceleration Framework here.