The top 3 questions founders have about SaaS B2B demand gen

Companies looking to scale up need to drive durable growth. Scalable demand gen programs can efficiently build new business opportunities and pipeline. This is especially true in today’s environment with slowdowns in demand, longer buying cycles, and smaller budgets. With countless tactics and strategies to choose from, and limited resources and capital to deploy, knowing where to invest and how to execute is critical.

What follows is data gathered from Insight’s portfolio of B2B SaaS ScaleUps. Insight Onsite – our in-house team of operational experts — has unique access to the data behind how demand gen strategy evolves as companies scale from the early stages through pre-IPO. We’ve guided hundreds of individual companies on that ScaleUp journey, which allows us to provide a deeper perspective on what the data means and how to apply it.

We will address three fundamental questions that our founders, CEOs, and leadership teams ask for guidance on:

- What is marketing’s contribution to pipeline?

- What demand generation tactics do we prioritize?

- How do we tailor tactics to our business?

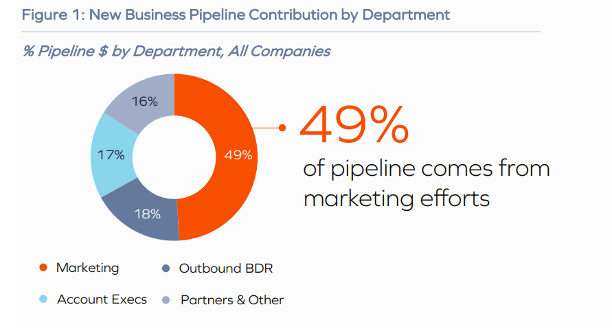

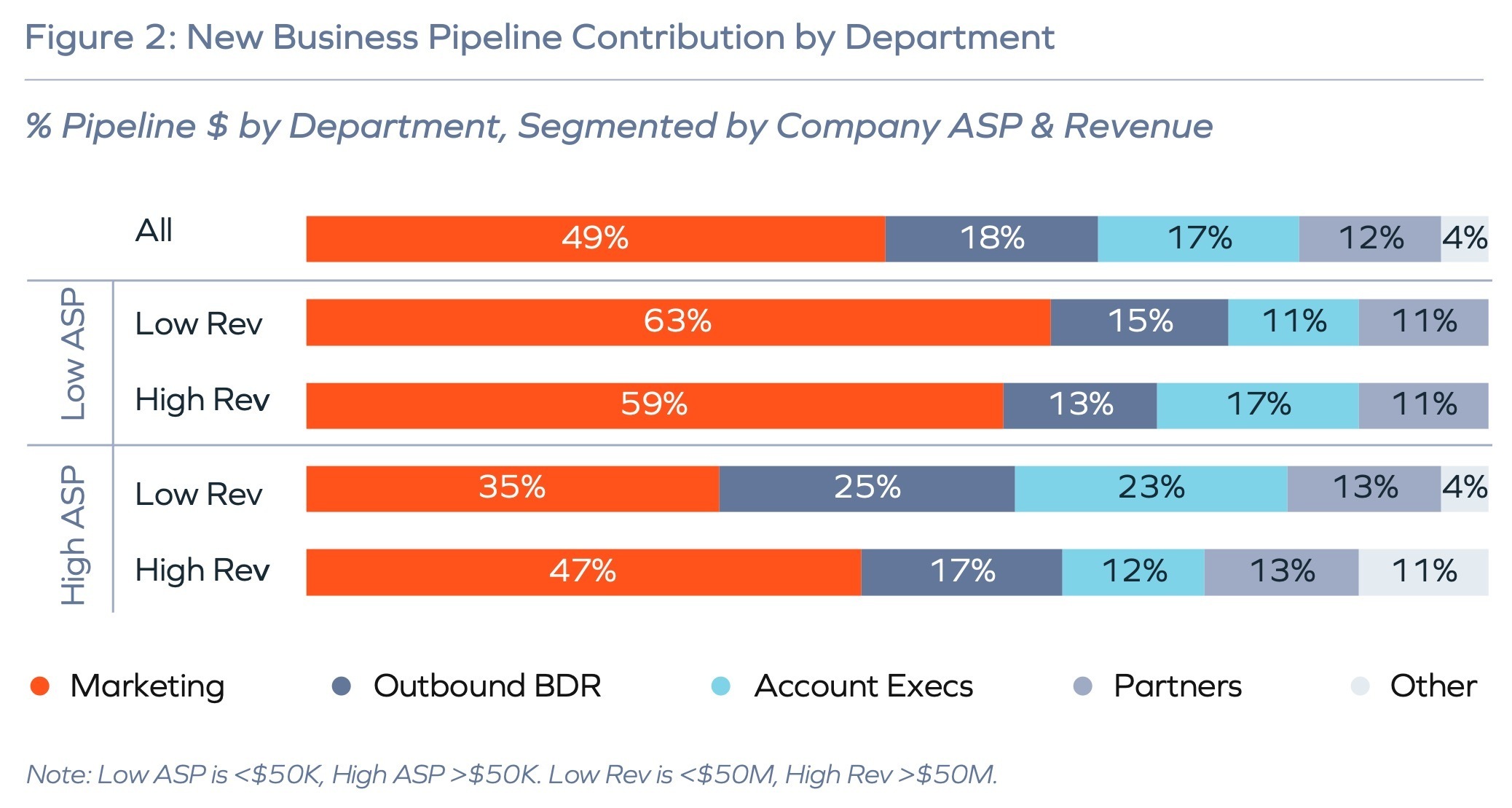

1. What is marketing’s contribution to pipeline?

Looking across the portfolio, marketing is the largest driver of new business pipeline, contributing 49%. This is followed by account executives (AEs) at 18% and outbound business development reps (BDRs) at 17%. (In this instance, pipeline contribution is measured by the $ amount marketing has contributed based on first-touch attribution.) However, marketing’s role evolves based on the stage of the company and its primary go-to-market (GTM) motion. For simplicity, we proxy stage of growth with the company’s revenue and GTM with its new business average deal size or average selling price (ASP).

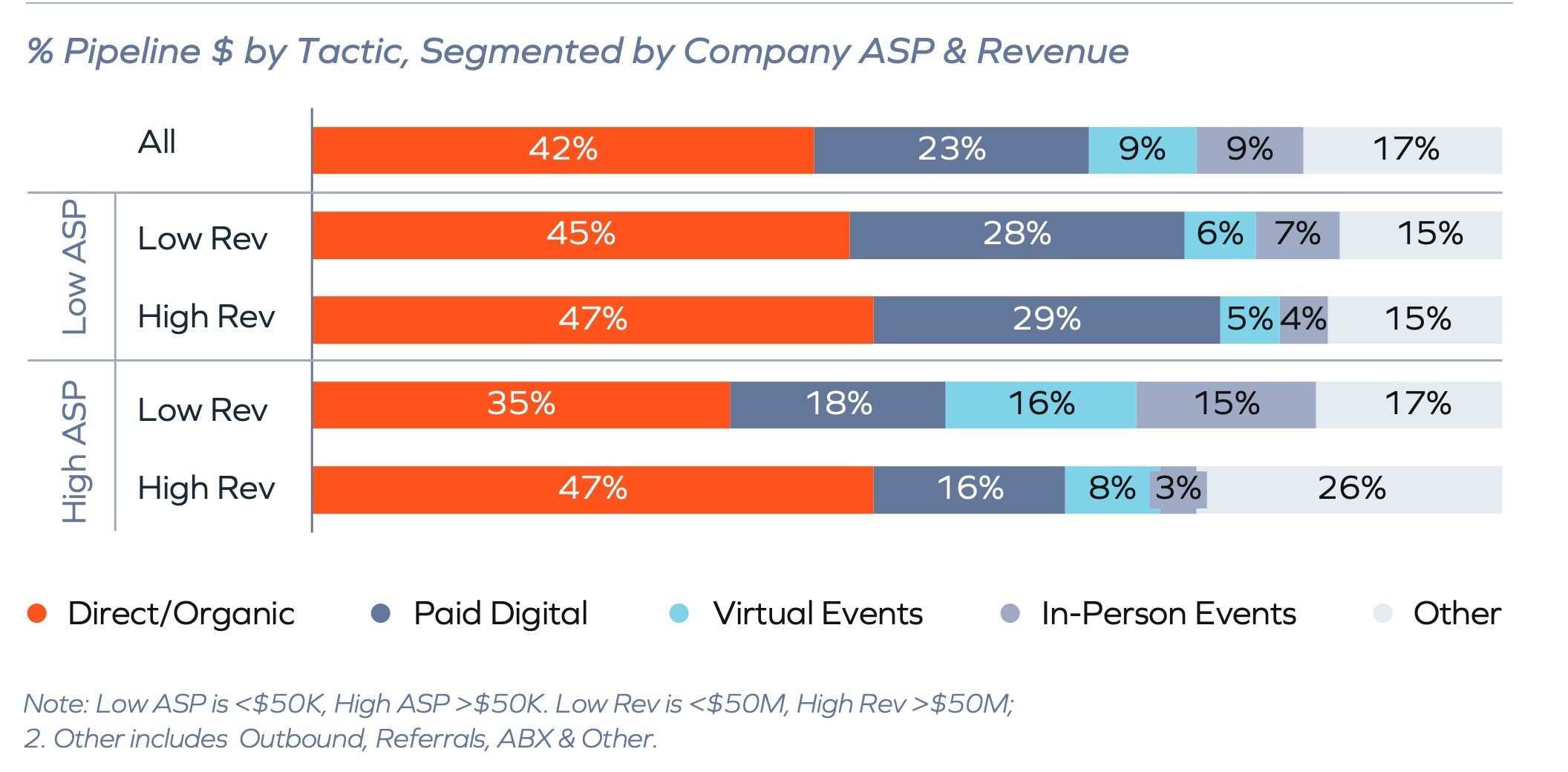

For companies with a lower ASP, marketing plays a larger role in driving pipeline. These companies sell to individual users, small teams, or smaller orgs and have a simpler sales process with low or no-touch sales. They rely on scalable demand gen to drive awareness, leads, and new business. As these companies scale, they tend to start selling larger deals to more senior decision-makers at larger companies. Marketing’s contribution decreases as the sales process becomes more complex, and there’s an increased need to add a human touch (i.e., sales touch) to navigate the buying process.

For companies with higher ASP, marketing’s contribution is generally lower. For early-stage companies, pipeline is often driven first by founders and their networks, then by outbound BDRs and AEs, with marketing playing a supporting role. As these companies scale, marketing’s contribution increases with a need to drive broader market awareness at scale, a move into new segments (e.g., mid-market), and/or the introduction of account-based strategies (ABM/ABX) for engaging large priority accounts.

2. What demand generation tactics do we prioritize?

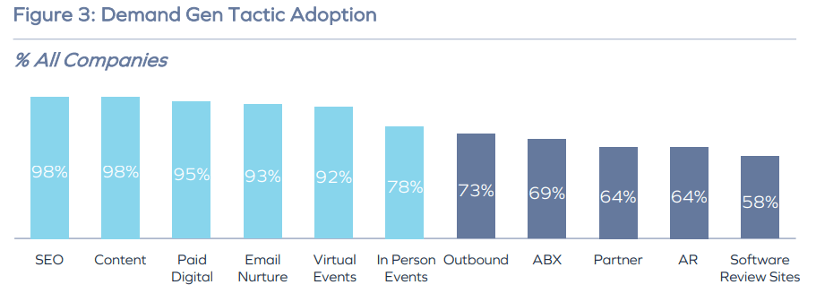

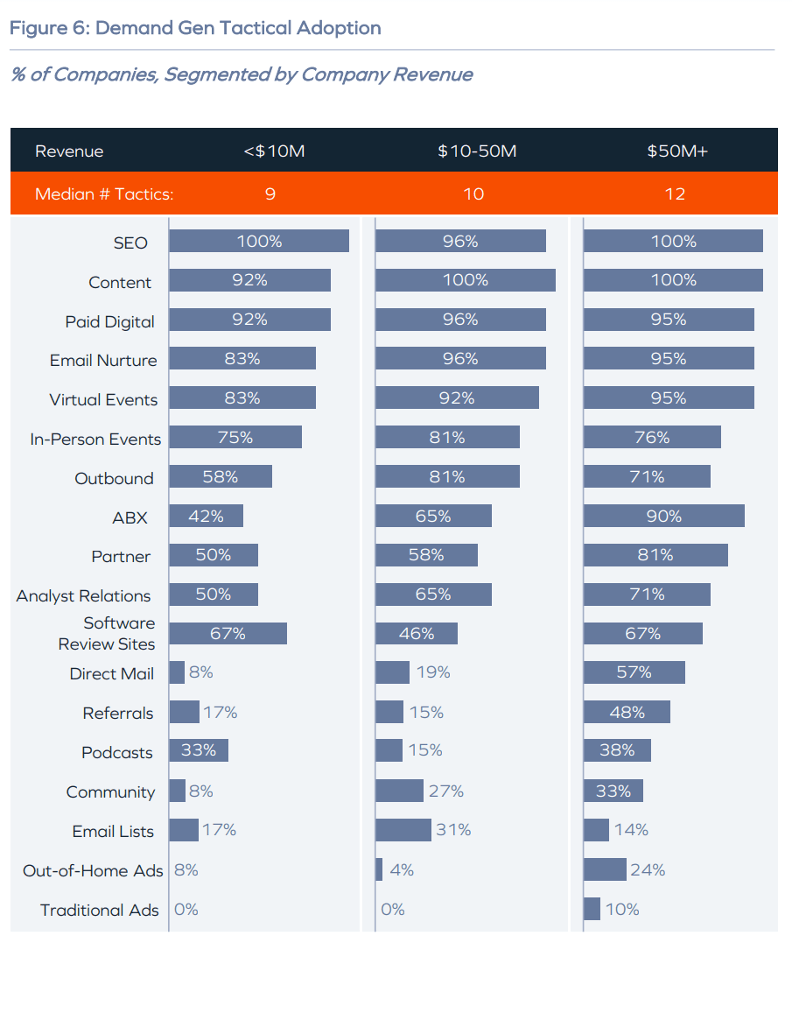

Regardless of company stage of growth or go-to-market motion, every SaaS company should adopt “table stakes” tactics – SEO, content, paid digital, email nurture, virtual and in-person events. Most of these have reached 90%+ adoption, except in-person events, which are still reverting to pre-COVID levels.

While it’s important to test new tactics, strong execution against these table stakes tactics is critical since they play an outsized role in driving growth. In aggregate, direct/organic search (driven by SEO and content), paid digital, virtual events, and in-person events drive 83% of marketing-sourced pipeline dollars.

Outside of table stakes tactics, there are “next frontier” tactics that companies are either ramping investment in and/or planning to test. These include outbound calling, account based (ABM/ABX), partner marketing, analyst relations, and B2B software review sites, among others. These are typically tactics that become relevant as the company scales and the team has more resources. Some of these (e.g., outbound calling and analyst relations) only make sense if you are targeting a specific persona or target market.

The number of tactics used increases as companies scale, moving from a median of 9 for those <$10M in revenue to 12 at $50M+. As companies scale, they reach maturity on table stakes tactics and have more resources they can deploy against new tactics and new goals; for example, investing more in brand-building tactics like podcasts and out-of-home ads.

3. How do we tailor tactics to our business?

The tactics you prioritize will depend on the key attributes of your business. While there are many to consider, the two key attributes we anchor on are stage of growth and go-to-market motion.

Stage of growth

(Proxy: Revenue.) As companies grow, they have more resources to drive demand gen maturity and increase the breadth and depth of tactics. Factors like market saturation, level of awareness, and size of customer base dictate the optimal demand gen tactical mix.

Go-to-market motion

(Proxy: Average new business deal size or selling price.) Companies selling lower average deal sizes into a larger market, typically targeting end users, will prioritize low-touch, digital tactics that efficiently drive a large volume of product trials and adoption. Whereas companies selling higher average deal sizes into more niche markets will prioritize high-touch tactics, orchestrated across channels, to educate and influence stakeholders to engage with the sales team.

Bottom line

Regardless of your company’s stage of growth or go-to-market motion, a scalable demand gen engine is fundamental to raising that next round, and eventually, a successful exit or IPO. Our top recommendations for driving efficient and effective demand gen are:

- Build the foundation of organic demand through SEO, content, and B2B software review sites.

- Layer on paid digital to accelerate traction; start with paid search/social and expand.

- Establish a regular program of hosted events; sponsor tradeshows when relevant.

- Focus on conversions; invest in website optimization and email nurture.

- Ensure messaging relevance and consistency across the buyer’s journey.

ScaleUp founders, CEOs, and leaders should use these insights as input into strategic discussions around demand gen strategy. Think of this post as a conversation starter for how much, and where, to invest to drive pipeline and ARR. As with all benchmarks, this data is a starting point and not a target. Benchmarks will vary by company type, resources, target audience, and goals.

Last, underlying any successful demand gen program is a deep understanding of your target customers and consistent, relevant messaging and engagement across marketing, sales, and customer success. Without this, demand gen programs will be ineffective, inefficient, or both.

Explore the SaaS Growth Acceleration Framework

Explore this topic and 40+ other critical business considerations in our interactive SaaS Growth Acceleration Framework for founders and GTM leaders.

Here’s how SaaS leaders ($10m + ARR) can use this framework to win:

- Understand the downstream implications of 40+ critical business decisions

- View how product-related decisions can shake the foundation of your go-to-market strategy

- Dig deeper into any GTM component to view key questions you should be asking when making changes

Note: Insight portfolio companies can get our full ScaleUp guide to B2B SaaS Demand Generation on GO, our community platform. This data-rich guide will dive into more details on the top strategies to prioritize based on your company’s stage of growth and go-to-market motion. Reach out to the Marketing Center of Excellence with any additional questions.