How PLG companies can scale efficiently by transitioning to hybrid sales

Is product-led growth (PLG) the only efficient growth panacea?

Many of the most successful software IPOs of the last decade have a common trait: a PLG operating model. The PLG business model has gained traction by being high-growth and operationally light by relying on the product, not human salespeople, to grow recurring revenue.

What the data tells us about PLG performance

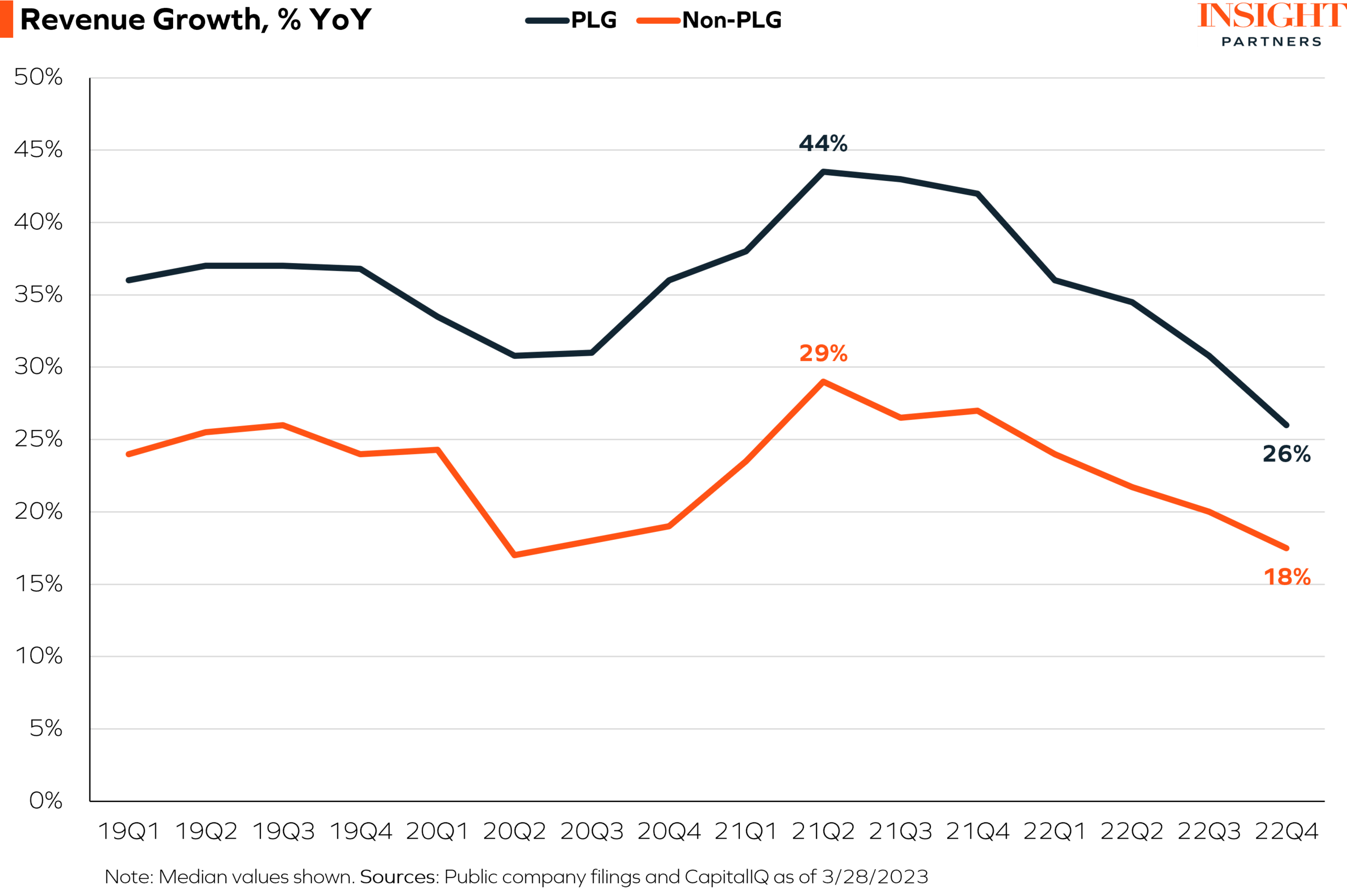

At Insight Partners, we examined publicly-available quarterly financial data from over 100 software companies to see how PLG and non-PLG companies have performed since 2019.

Over the last few years, publicly traded PLG companies grew faster than their non-PLG peers.

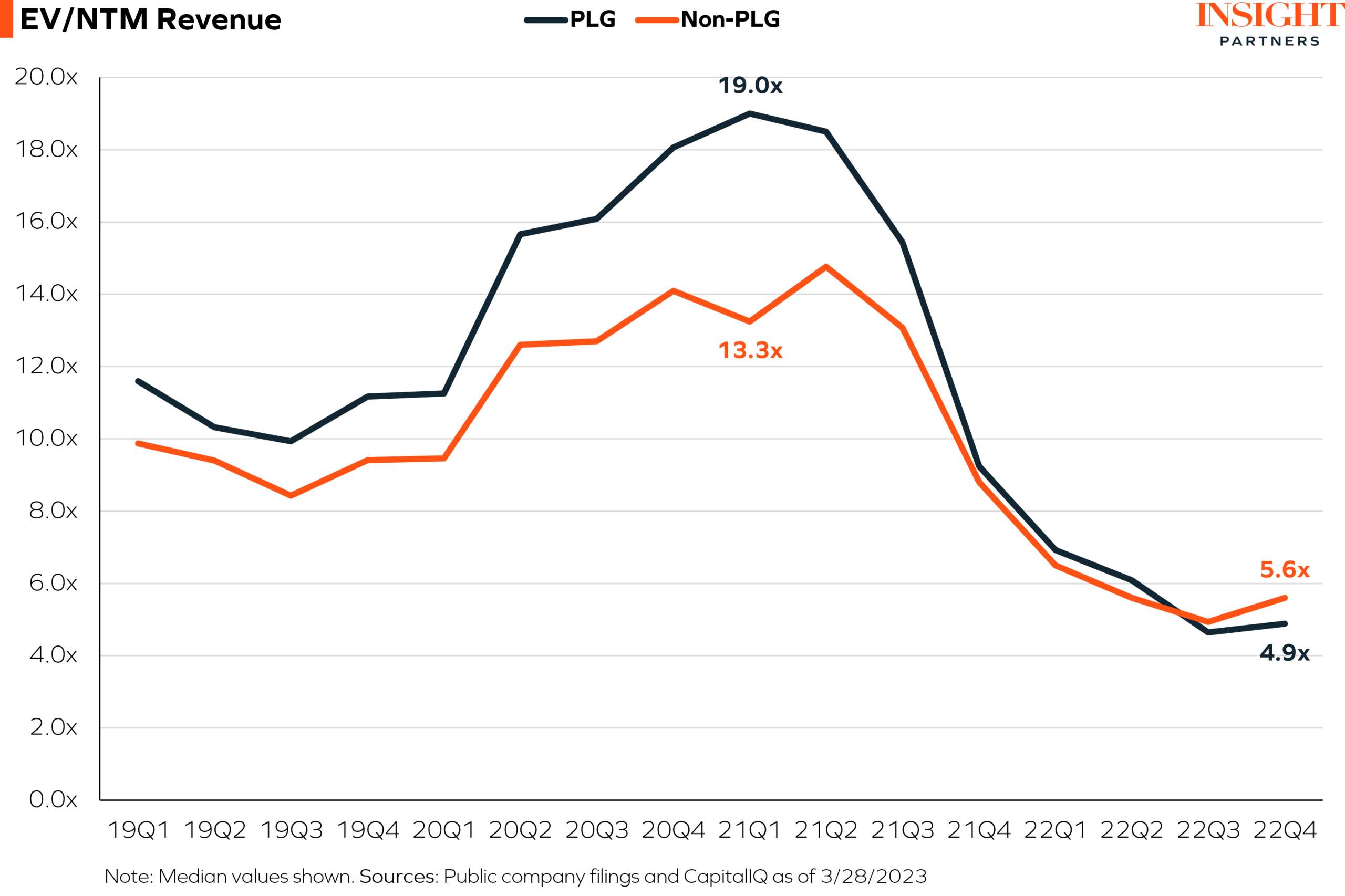

However, in 2022, software sector valuations declined due to rising interest rates and other macro factors, and investors shifted to valuing operating efficiency (vs. growth at all costs) more than in prior years. One may have expected PLG companies to maintain their valuation multiple premiums relative to non-PLG companies due to the perceived lower sales spend required.

Surprisingly, that has not been the case. Both PLG and non-PLG companies saw their EV/NTM revenue (enterprise value/next twelve months revenue) multiples decline in 2022, but non-PLG companies were valued at a slight premium relative to PLG companies starting in Q3 of 2022.

Why are PLG valuations lower now if efficiency matters more? Don’t PLG companies have lower operating expenses because the product sells itself?

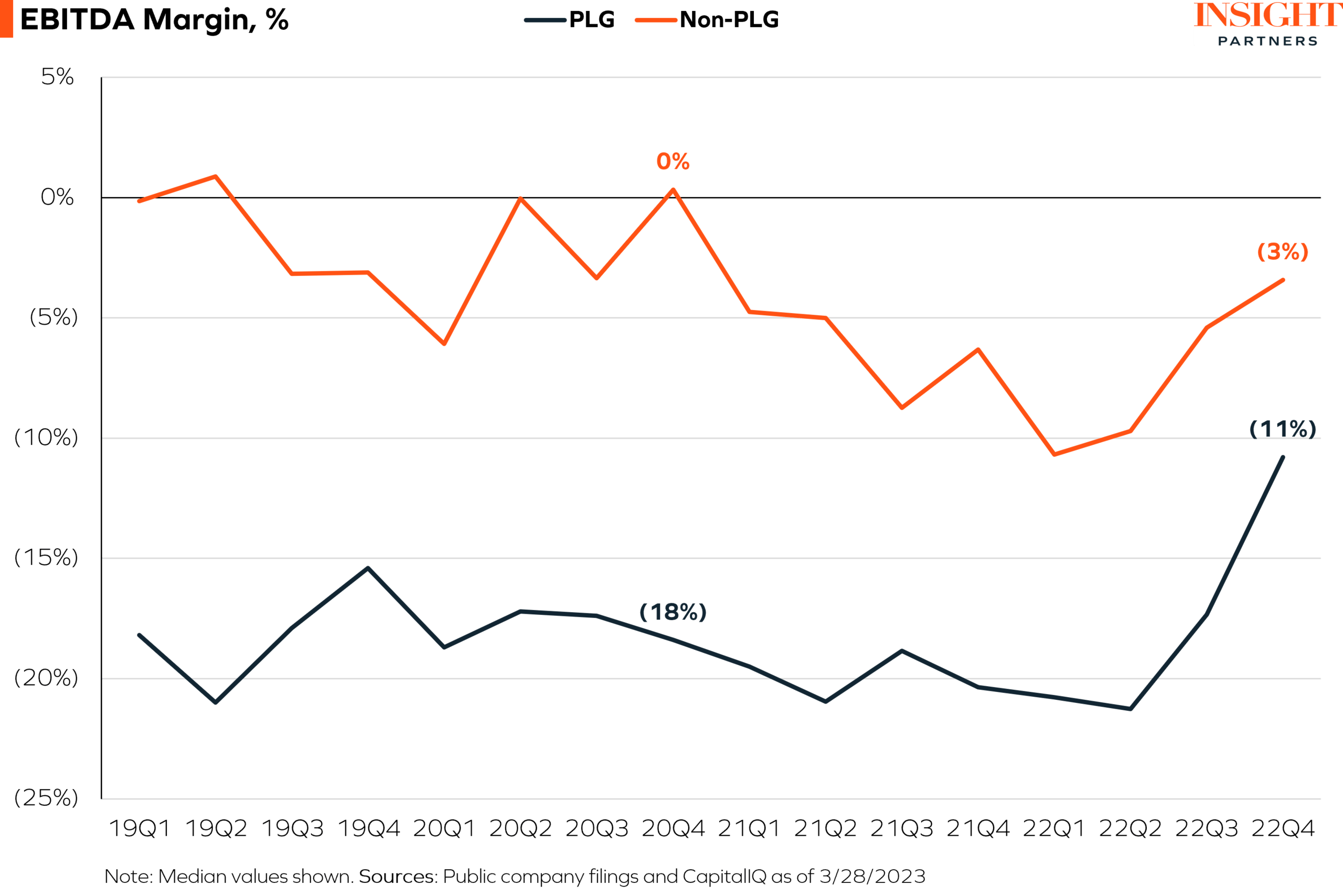

The data suggests otherwise. While quarterly EBITDA margins for both groups trended upward in 2022, non-PLG companies maintained higher EBITDA margins, leading to higher valuation multiples.

Why have public PLG companies been less profitable?

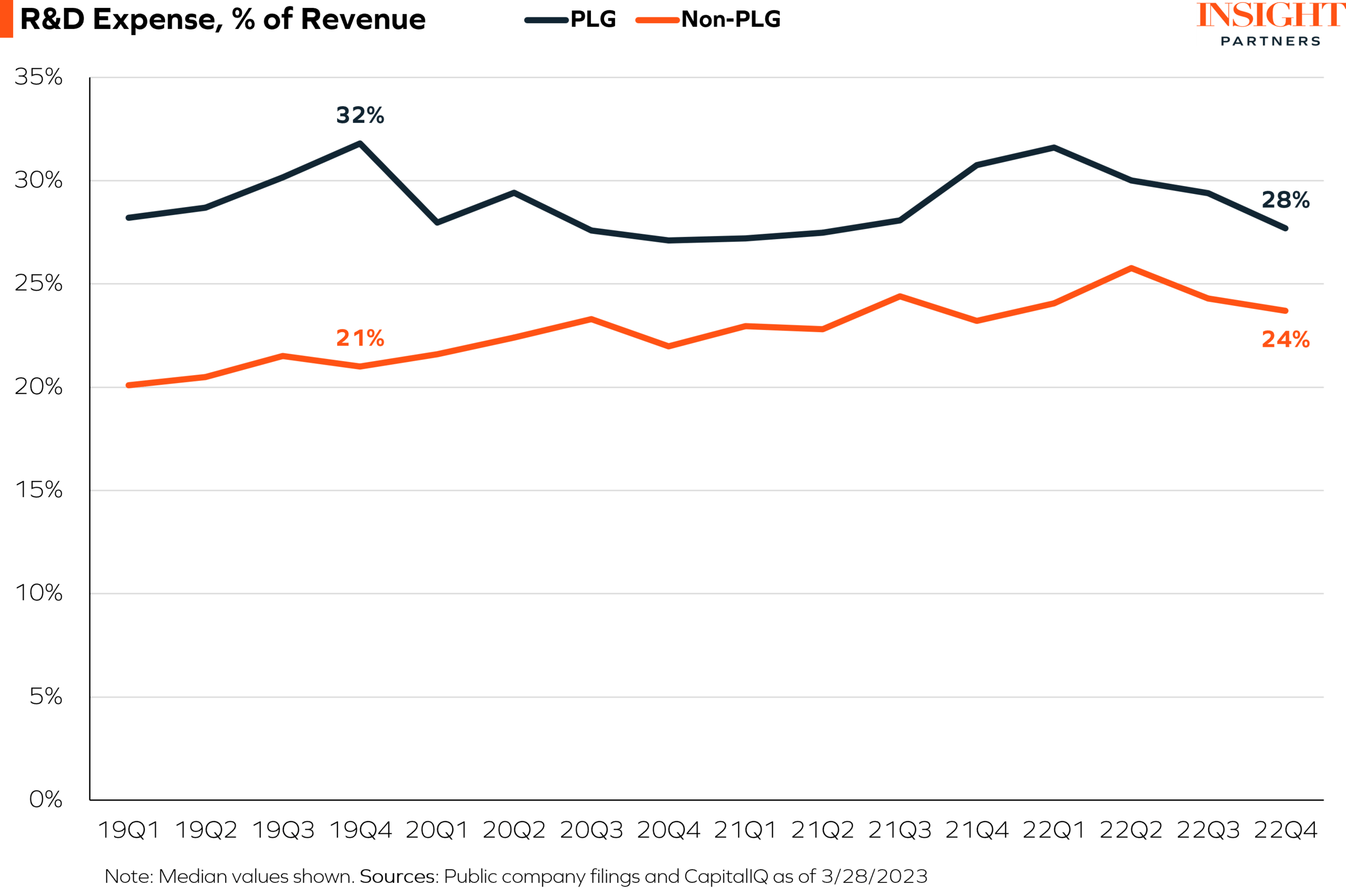

PLG companies have relatively higher R&D (research & development) expenses as they focus more on product investments to drive user acquisition, paid conversion, onboarding, and expansion. Engineering and product costs replace and/or augment sales team activities.

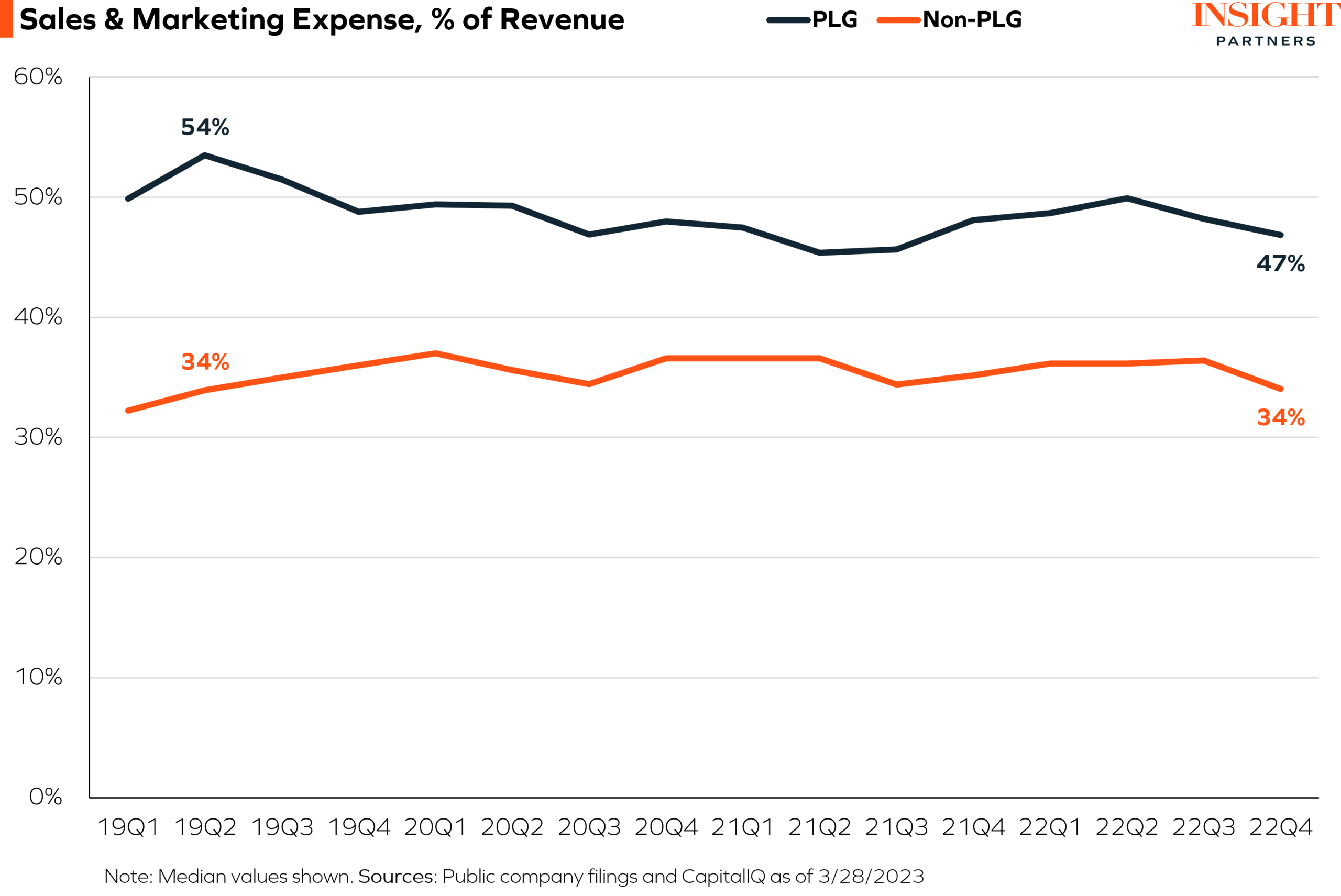

However, while you might expect PLG companies to recoup the higher R&D expense with lower sales & marketing (S&M) expenses, that is not the case. In fact, the reverse is true – PLG companies spend more on S&M as a percentage of revenue than non-PLG companies to drive both acquisition and expansion (chasing net revenue retention).

PLG R&D costs, along with S&M costs, led to higher growth rates. As seen in the initial charts above, this strategy of higher growth relative to non-PLG peers produced higher median valuation multiples before 2022, when markets valued growth over all else. This trend reversed in 2022. Why?

While PLG can be an effective and efficient startup activator, PLG companies often need to build additional routes to market to scale revenue (e.g., enterprise companies may need an outbound sales rep to prospect into new logos). However, balancing growth and efficiency is difficult when building new sales motions. PLG companies need to ensure they have the right people, processes, and technology when expanding their routes to market rather than relying on their existing PLG infrastructure.

Read more: Decoding PLG: Navigating efficiency and growth in today’s software market

Improving PLG sales and marketing ROI for sustainable growth

To create sustainable high-growth companies, PLG companies should consider two priorities.

- Improve ROI in marketing spend

- Improve data ETL (extract, transform, and load) between go-to-market (GTM) channels to increase the effectiveness of sales-assist

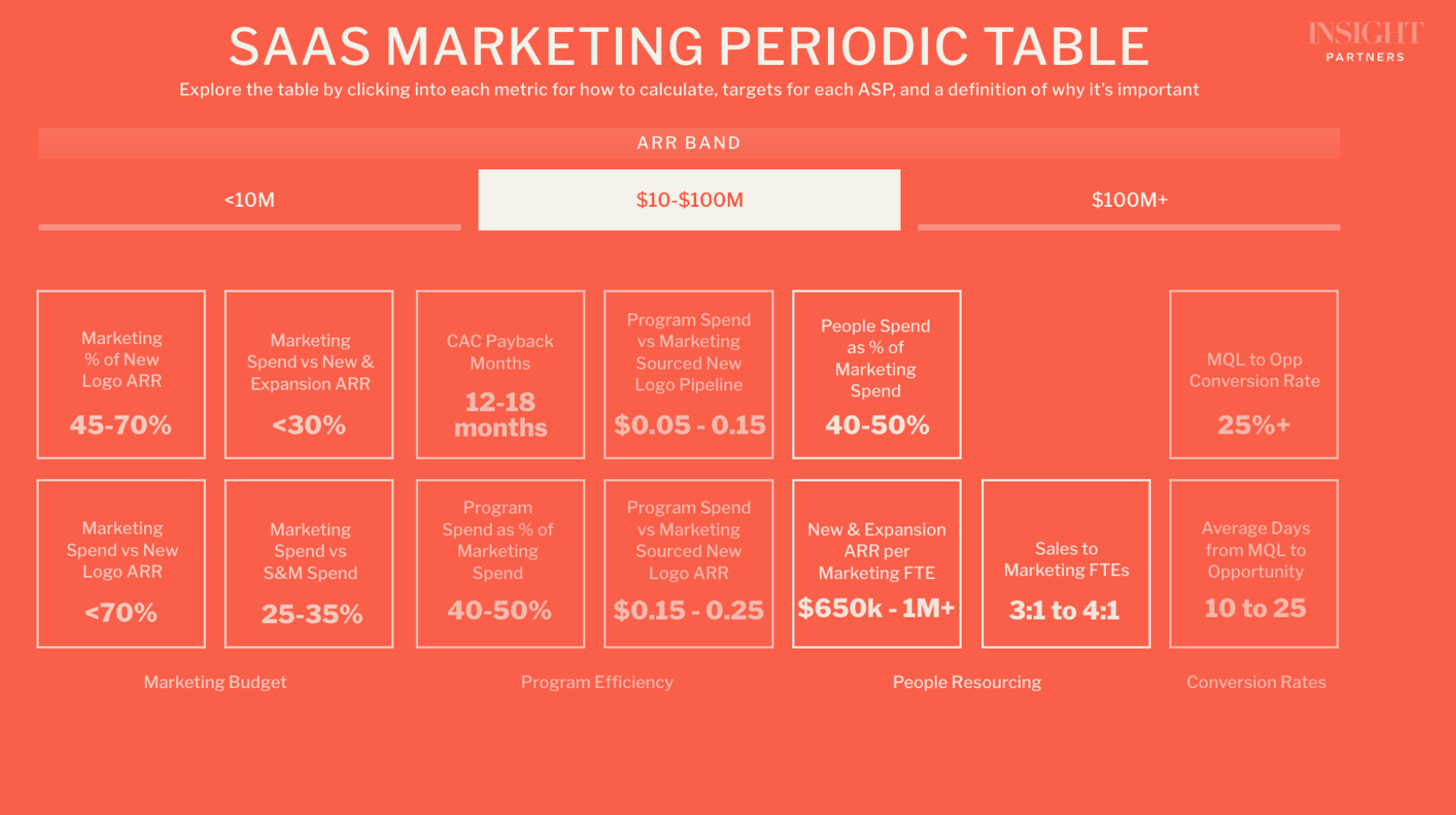

Short-term: Improve ROI in marketing spend

Public companies do not break out sales and marketing expenses separately, so it is hard to know for sure which is the culprit. However, as ScaleUp investors, we know that most PLG companies spend more on marketing as a percent of revenue than non-PLG companies, in order to drive user acquisition, conversion, product engagement, and community building.

Lower costs

Automating lead qualification. PLG companies generally have more data and information on every lead. Ensure you are not manually qualifying leads and paying overhead for a process that can be automated.

Reduce martech costs. PLG companies tend to spend a lot on martech. These are often point solutions, including data augmentation, web personalization, and measurement across web and product entities – alongside high-cost platform solutions like a customer data platform. But companies have to monitor their software spend and avoid incurring bloated tool costs. We recommend shifting towards platform solutions with an integrated network to reduce costs.

Increase revenue

Focus on generating high-conversion users. If marketing only focuses on generating total top-of-funnel free trial users, it may lead to a top-heavy funnel with a low number of paid users. To avoid this, first, define your ideal customer profile (ICP) and target personas, and narrowly target those users with digital marketing channels. Add additional targeting elements, including geography, company size, and technographic data to reduce spending on poor fit leads and increase free-to-paid user conversion percentages. While your cost per lead or cost per free trial may increase, it should be offset by higher paid conversion rates.

Prioritize program spend based on outcomes. Ensure the program budget still targets and prioritizes channels that produce bookings. PLG companies often over-index on channels that have a low cost per lead or cost per free trial but fail to consider how effectively those channels convert leads to actual revenue. Not all leads are created equal.

Long-term: Improve data ETL between GTM channels to increase the effectiveness of sales-assist

As PLG companies scale, they often develop multiple sales-assisted GTM channels to supplement their PLG motion (e.g., outbound, inbound, channel, etc.). However, high operational infrastructure and rigor are required to support those channels as the volume and velocity of individual users can make it really complex to use their data to supplement a sales-led motion. Investments in processes, systems, and data management have a long implementation timeline but pay big dividends through a better sales-assist program.

In order to optimize your sales-assist motion, your reps need a complete view of the customer to know if the company is a good fit (i.e., ICP) and if there are product signals that tell you they are ready for an enterprise contract. Customer relationship management (CRM) and product user data are often challenging to reconcile due to different data structures, and the sheer volume of individual free, trial, or paid users. This often leads to multiple tools for different GTM channels with no single source of truth for account/user data. PLG companies need to (re)construct their data model so that product, marketing, sales, and success have a unified view of the customer in a format that is most intuitive and useful for them to action.

Explore the SaaS Growth Acceleration Framework

Explore this topic and 40+ other critical business considerations in our interactive SaaS Growth Acceleration Framework for founders and GTM leaders.

Here’s how SaaS leaders ($10m + ARR) can use this framework to win:

- Understand the downstream implications of 40+ critical business decisions

- View how product-related decisions can shake the foundation of your go-to-market strategy

- Dig deeper into any GTM component to view key questions you should be asking when making changes

Data for these charts comes from quarterly financial data from 100+ public software companies. Public company data as of 3/28/23 from Capital IQ.