How the Wiz cofounders turned a longstanding friendship into a revolutionary cybersecurity company

The leaders of cloud security company Wiz were close friends long before they became cofounders.

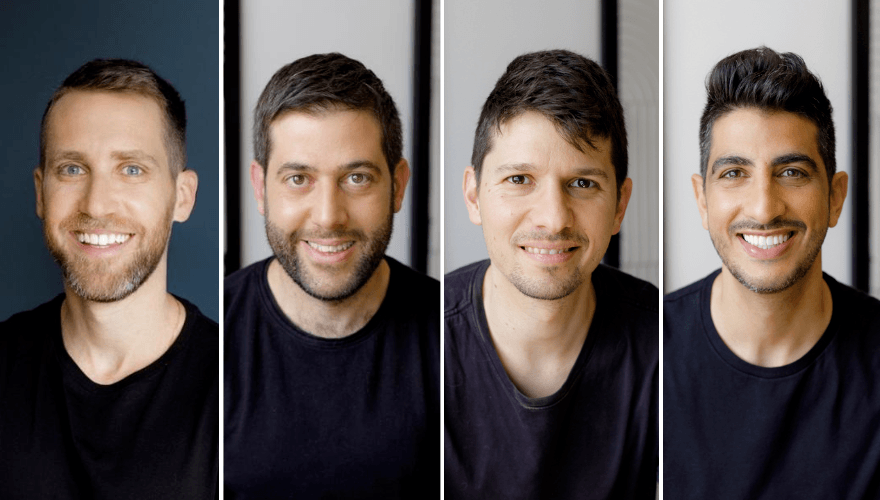

Ami Luttwak, Assaf Rappaport, Yinon Costiva, and Roy Reznik originally met as teenagers back in 2001 when they served together in the Israeli army.

“I was 17 when we met,” says Luttwak. “It was 22 years ago. That’s part of our story. This is not the first startup we’re building together.”

“I think part of the magic of that relationship is how different we all are,” says Rappaport. “Each cofounder has a distinct personality, and it allows us to bring out the best in each other.”

They grew up together, came to understand the world together, and ultimately managed to evolve their strong and distinctive bond from friends to business partners.

Adallom acquisition and Microsoft years

It’s a bond that has lasted throughout a number of companies. In 2012, the foursome created Adallom, a cloud access security broker. Three rounds of funding led to $50 million of investment. Adallom wasn’t an overnight success story. The company gave customers visibility and control over access to their applications and data, but it took years for the market to develop, catching up to what the founding team had recognized as an opportunity.

The market did eventually catch up, and Microsoft bought the company in 2015. The foursome joined the tech giant to lead cloud security. There, they got a crash course in building for the enormous scale that Microsoft required.

“We came to Microsoft with the Adallom product,” says Luttwak. “Part of the transition was to remove maybe 75% of the features, but to make it scalable.” They integrated Adallom into Microsoft and ultimately deployed the product to 100 million users.

“The transition to Microsoft taught us how to view startups in a different way,” says Luttwak. “It wasn’t a feature fight. It was: ‘How do I build a scalable product that, from an engineering perspective and also from a usability perspective, anyone can use? And how do I do that without adding complexity in deployment and usage because you’re aiming for huge scale.”

Creating the “Switzerland of cloud security”

The Adallom team was Microsoft’s biggest cybersecurity acquisition at the time and a key part of building a new business within the company. Luttwak recalls the four years at Microsoft as being “amazing,” not just for Adallom and the cloud security product but for seeing how a huge organization can scale a completely new business.

“When we started, Microsoft didn’t have any security sales,” says Luttwak. “When we finished, it was around $1 billion a year.”

When we started, Microsoft didn’t have any security sales. When we finished, it was around $1 billion a year.

Still, the four cofounders got restless and saw an opportunity to build products that could function across many cloud platforms. “One of the things that spurred our departure was the prospect of providing a solution for cloud security teams that extended beyond Azure and truly supported multi-cloud environments,” says Rappaport. “You might say what we envisioned was the ‘Switzerland’ of cloud security.”

They wanted to go it alone once more. “We decided that it’s time to start something completely new, to try to disrupt an existing market,” says Luttwak. “And that’s when we decided it’s time to leave and really try our luck and create Wiz.”

Wiz is born

The decision to give up comfortable jobs in a large company like Microsoft is a tricky choice at any time, but the stakes felt even higher for the four longstanding friends. “When you start a company, it’s quite a frightening experience because no one likes to fail,” Luttwak says. “But of course, the second time, there are higher expectations.”

The founders knew that people would be comparing the trajectory of their new company to the success of Adallom – and anything other than enormous growth would be seen as a disappointment.

But they didn’t let high expectations dissuade them from their big idea.

While at Microsoft, they had identified a hole in the cloud security market: Unlike with on-premise cybersecurity, there wasn’t a way for security teams to view all their cloud servers in a “single pane of glass.”

“The market existed for 15 years,” says Luttwak. “Although you had multiple products, none of them actually solved the problem. That happens sometimes: you have products, you have a market, security teams buy the product. But they don’t actually solve the problem. And that’s where opportunity arises.”

You have products, you have a market, security teams buy the product. But they don’t actually solve the problem. And that’s where opportunity arises.

The team launched Wiz in January 2020 to rethink how cloud security teams could understand their infrastructure across multiple cloud vendors: “After talking with a lot of teams, we came to the realization that what’s broken is not a specific feature or functionality,” says Luttwak. “What is broken in cloud security is that the entire operating model of how you do security needs to change.”

They convinced customers and financial backers that they could be that change. “We worked with our existing investors, and we got a very big investment from day one – around $20 million,” says Luttwak. The high investment was a double-edged sword. “That’s pretty scary,” says Luttwak. “You want to succeed. You believe in yourself. But it’s still a startup, you know. There’s a lot of expectations from you.”

Building for scale

Wiz ultimately became one of the fastest growing security startups of all time, and the team attributes that, in part, to the cofounders’ dynamics and their experience building both startups and within Microsoft. “I feel this team now has multiple superpowers,” says Luttwak. “We had gone through a startup phase and the Microsoft phase.”

The group had built what Luttwak calls “the scalable startup.” It’s a different model from how the team operated at Adallom: usually, in a startup, the founders are focused on whatever the customer wants. “But in a scalable startup, you think like Microsoft: this is going to be used for 10x, 100x the load we have today because we’re going to succeed. So let’s build in a scalable manner.”

“An unbelievable journey”

The Series A funding from Insight Partners and others in December 2020 has allowed Wiz to scale in a way that has defied expectations. It was aided by many of the team being long-tenured colleagues of the founding team. Just as the four cofounders had sustained connections, a surprisingly large number of Wiz’s engineers are people the founding team encountered 15 years ago at Adallom.

That inherited institutional knowledge, alongside nailing the product-market fit, has helped Wiz to grow to what it is today following its launch out of stealth. “It’s been an unbelievable journey,” says Luttwak, “and a lot of it is because of our customers, right? Customers using the product is the best way to get more usage.”

Word of mouth, combined with the fact that cloud security isn’t an issue going away any time soon, has helped pave a path to continued success for Wiz, reckons Luttwak. The company hit a $100 million ARR within only 18 months of reaching $1 million, showing the scale of growth in the sector.

The company hit a $100 million ARR within only 18 months of reaching $1 million

“What’s beautiful in the problem we’re trying to solve for customers is that it just keeps growing,” he says. “The cloud gets bigger. There are more technologies in the cloud. The complexity of the cloud just grows.”

And Wiz plans to help companies navigate that complicated world. “We want,” says Luttwak, “to help companies get clarity in that complexity.”

Scale up your career: See all open roles at Wiz on the Insight Partners job board.

The investor POV

How one call with the team behind Wiz changed Teddie Wardi’s mind on the company.

Tech investment is a connections-based business. Instinct can play as significant a role in whether a deal comes to fruition as careful research and diligence, as the story of Insight Partners’ investment in Israeli cybersecurity company Wiz shows.

“The ecosystem in Israel in startups overall, but especially in cybersecurity, is pretty tight-knit,” says Teddie Wardi, Insight Partners managing director. Insight had previously invested heavily in the Israeli cybersecurity sector. So it was only natural that Wardi would hear about what the founding team behind Wiz was cooking up.

“We kept hearing stuff about the team, but we had never met them,” says Wardi. When Wiz raised a seed round early in 2020, they bubbled back up to Wardi’s desk in late 2020, seeking Series A funding. At that point, Wardi decided to get in touch with the four cofounders behind Wiz.

“It was a short window of time getting to know them and partnering up,” he says. “It was almost like one phone call where we decided these guys were up to something pretty brilliant, and we needed to partner with them.”

“Timing matters a lot”

The hour-long phone call helped convince Wardi that he should support the startup at the start of its journey. “Investment decisions are always a composite of things,” he says.

One of them is understanding the context in which you’re making an investment. Insight Partners has a storied history of investing in cybersecurity companies. They knew the problems with cloud security and how startups could help solve those issues. “Wiz was there at exactly the right time – and timing matters a lot,” he says.

“Wiz was there at exactly the right time – and timing matters a lot”

The technology behind the company was also scrutinized. “They had this initial technological hook called agentless scanning,” says Wardi. “It allows them to plug into the customers’ environments in a very fast and cloud-native way, which means the product is quick to try out and deploy.”

The team and the tech

Then investors looked at the team – and Wiz’s cofounding team. They had together founded a prior company, Adallom, a security company that was acquired by Microsoft in 2015, where the founding team ended up working for a number of years. “They had success in the past selling their startup,” says Wardi. “They had done well in a big corporate environment and proven they can also achieve large scale things and work with large enterprises.”

But even if a company is in the right place, at the right time, with the right product from the right founding team, making that choice to buy in can be tricky. So a phone call was still needed.

Wardi prides himself on approaching those conversations with a technological mindset. He focuses specifically on products over just people. “For us, even in early stage investing, it’s important that the team has built out a first iteration of the product,” says Wardi, “and there’s some evidence that they’re selling.” That evidence? Wiz entered the phone call with Insight after having secured two major multinational enterprise customers for its cloud security services.

The full-stack founder

However, there were still doubts in the back of Wardi’s mind. Many businesses come to pitch themselves to Insight, and the company’s experts have learned how to separate the wheat from the chaff. “Besides telling the story about why they started the company and what was their advantage, I poked [Wiz cofounder Assaf Rappaport] on the technological approach,” he says. “What has he built so far? What is he going to build in the next year?”

The goal was to understand whether the promise of the future was hot air or if the team could do what they said they would. Wardi was blown away by the level of detail and clarity of vision within the responses. “Assaf rolled with the punches very well,” he says. “He knew every detail, to the extent that a CEO wouldn’t even have to. It impressed us that he’s a full-stack founder. He knew the ins and outs of this thing. And that gave us confidence in him as a leader.”

“They broke the mold”

Wardi came out of the call far more confident in the idea of investing in Wiz than he entered it. Indeed, he almost didn’t take the call — the company was raising a very large round of funding for the stage they were at in their development, which made Wardi naturally skeptical of whether the company had been overhyped.

However, when Rappaport started getting into the nitty gritty details of how the technology actually works, how quickly they can deploy it within a customer, and why it was transformative compared to all the other solutions already out there on the market, he was convinced.

“It’s been a tremendous story from a growth perspective,” says Wardi. “They’ve accomplished much more than what they said they would and what we expected them to do. They broke the mold.”

Interviewed by Chris Stokel-Walker for Insight Partners.