Despite making up half of the global population, women and their health needs are underinvested in, underserved, and under-researched. It takes women four years longer than men to get diagnosed with 700 different diseases and conditions. This not only creates poor health outcomes for women but also considerable costs to our healthcare system.

The fraught challenges within women’s health present massive opportunities and potential value creation for current and future founders of software companies. As increased awareness, research, and education drive innovation, more healthcare and technology investors will take notice.

The history of gender health gaps

Over the past ten years, the women’s health tech industry — femtech — has come to represent a wide range of products and solutions addressing conditions specific to women (defined for the purpose of this article as people with vaginas, however they identify) and conditions with a different or disproportionate impact on women.

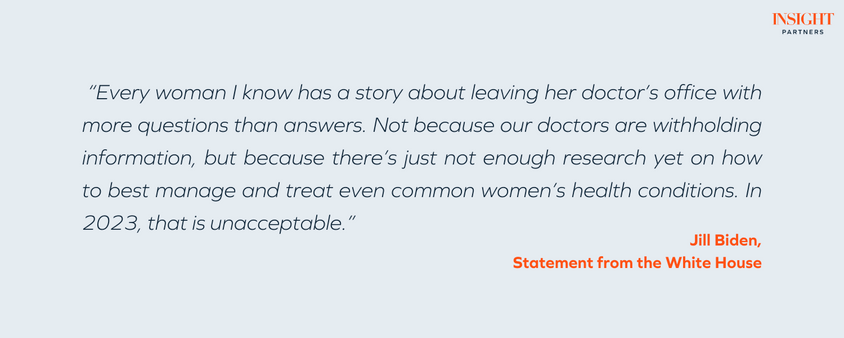

Momentum in the sector is undeniable. On November 13, 2023, the White House announced its first-ever Initiative on Women’s Health Research, which encourages the research necessary to pioneer the next generation of discoveries in women’s health. In a statement from The White House, Jill Biden said: “Every woman I know has a story about leaving her doctor’s office with more questions than answers…there’s just not enough research yet on how to best manage and treat even common women’s health conditions.”

2023 was also the 30th anniversary of the NIH Revitalization Act of 1993, which required the inclusion of women and underrepresented populations in clinical research for the first time. Prior to this change, medical trials and research were conducted with mostly men, creating the gender data gap we are still working to counteract.

With each passing year, the body of data on women’s bodies continues to grow and foster new discoveries that can improve women’s health. At Insight Partners, we’re excited about the opportunities this sector presents and look forward to adding to our growing roster of women’s health investments.

The industry

The term “femtech” was coined in 2016. Giving the industry a name created a category, making it easier for the pioneers of women’s health to convey the opportunity it represented to investors. At Insight, we use femtech and women’s health synonymously, but never as a cover for talking about the real issues directly. Whether it’s breast cancer, vaginal infections, urinary incontinence, menopause, or anything else — as investors, naming and openly discussing women’s health conditions is vital to unlocking a deeper understanding that leads to better clinical outcomes and patient experiences.

The gender health gap is made evident by many data points over the last decade. For example, an analysis of federal spending published in The Journal of Women’s Health found that twice as much funding goes to diseases that disproportionately affect men compared to those that primarily impact women.

As this data emerges, it fuels increased discussions around women’s health issues. Now, conversations are taking place not just among friends and family but in the workplace as well. The New York Times’ viral article “Women Have Been Misled About Menopause,” details how the medical community has systematically let women down and is a prime example of how women’s health awareness is finally taking center stage.

Still, taboos around women’s bodies remain and are detrimental to progress. Advertising bans on social media regularly censor certain words and images related to women’s health. Women’s health giant Bodyform recently had one of its advertising campaigns inaccurately labeled as “sexual content” after using anatomical words such as vagina and vulva. Images of period blood are also routinely blurred out in internet searches. This systemic challenge creates undue barriers for startups trying to reach women and share accurate information.

Nonetheless, growing awareness from government, medical professionals, and women more broadly presents a rich opportunity for founders to bring to market the products and services that women deserve.

The investment landscape

As conversations around women’s health increase, so too does the industry’s valuation. According to Fortune Business Insights, the global femtech market will reach over $20B by 2030 – up from an estimated $6.69B in 2023. The nonprofit Femtech Focus is even more bullish, projecting the industry to be worth as much as $1T by 2027.

The unmet needs of half of the population present an opportunity to improve health outcomes. So, too, does the fact that women are often the ones in charge of household spending. According to McKinsey & Company, women account for 80% of consumer purchasing decisions in the healthcare industry.

This has led to the formation of several femtech-focused venture capital funds. Steelsky, Rhia Ventures, Amboy Street Ventures, and Avestria Ventures focus exclusively on finding and supporting the next generation of innovators in this sector. It’s an area with huge investment potential. And yet, despite the increased attention, the overall investment in women’s health remains low. According to Rock Health, only 3% of the 2,728 digital health deals in the U.S. between 2011 and 2020 focused on women’s health.

Of course, there have been some notable success stories. Maven became the category’s first unicorn in 2021, and fellow fertility-focused startups Progeny and Kindbody have also exceeded $1B valuations. In 2023, femtech companies were worth a collective $28B. Global VC investment into femtech companies also reached an all-time high of $2B in 2021 seeing a steady rise since 2013.

The market for women’s health tech can be stratified across conditions, life stages, end customers, business models, and regulatory pathways. Each of these categories helps define the femtech landscape. For example, with provider shortages across many conditions, tech-enabled services certainly have an important role to play in shaping the next generation of femtech companies. At Insight, our core focus is software, and we have an unwavering belief in software’s power to transform healthcare delivery for the better that guides our investment approach.

The opportunities

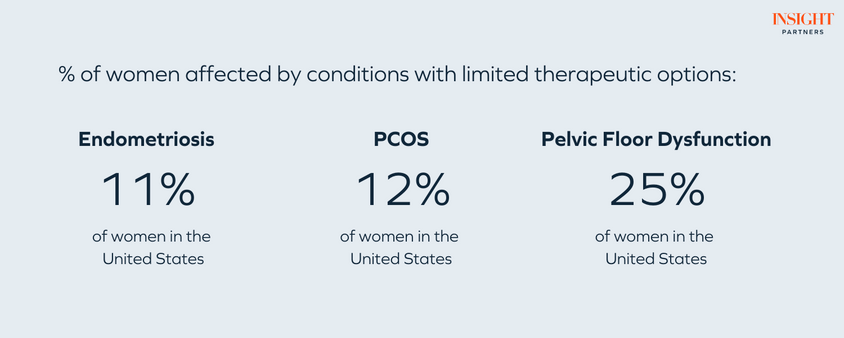

Women’s health has a wide range of challenges, and, therefore, opportunities to explore. When considering the market, we include conditions that both solely impact women, like endometriosis and menstruation, and those that disproportionately or differently impact women, such as heart and urinary health.

Founders in the women’s health space are playing an outsized role in driving education about women’s bodies and fostering public discourse around some of the biggest issues within women’s health.

Technology has a significant role to play as well. Globally, medical school curriculums remain behind the curve on women’s health, creating continued gaps in medical training for conditions like menopause; according to Healio, only 31% of OB-GYN directors report having had menopause on the curriculum. This lag in medical education creates an opportunity for digital offerings to step in and provide scalable and cost-effective solutions where doctors fall short.

Two trending areas are garnering attention from founders and investors alike: fertility and menopause.

What’s trending?

Fertility

Reproductive health is something of an outlier when it comes to women’s health investments. It is a condition that impacts everyone, but treatment falls disproportionately on women. While it is a relatively well-established investment area, significant growth in services is expected (and needed) to meet the massive supply-demand gap that exists today.

Some estimates put the value of the industry around $8B, but, like women’s health in general, this figure varies. Although 16 states in the U.S. mandate some insurance coverage for fertility, couples largely fund their treatment out-of-pocket, with one cycle of in vitro fertilization (IVF) costing $12,000 to $14,000 on average. In 2021, there were 413,776 assisted reproductive technology (ART) cycles in the U.S. with an average of 2.3% of all babies born in the U.S. as a result of ART.

The prevalence of treatment costs and increasing demand have created a highly competitive market, prompting fertility clinics to adopt new technologies. Insight portfolio company AIVF supports clinics and labs with AI solutions that help embryologists with embryo grading – leading to higher rates of success for patients and IVF clinics. Fertility benefits have seen a particularly strong market pull, producing unicorns Progyny, KindBody,and Maven as well as Carrot, and others. Gameto, another one of Insight’s portfolio companies, works to address the growing demand for ART while vastly reducing the level of ovarian stimulation required, aiming to improve women’s treatment experience and likelihood for success.

Menopause

While fertility is the frontrunner in new company creation and investment, menopause — which affects all women — is fast becoming a focus area for women’s health tech. Companies like Midi, Evernow, Alloy, and Lisa Health offer women much-needed menopause care. The global value of the menopause market is expected to reach $24.4B by 2030, and venture capital firms invested $530M in menopause care between 2015 to Q1 2023, according to SJF Ventures.

There are 40+ menopausal symptoms that women experience over a 20+ year period, costing an estimated $1.8B in lost working time in the U.S. For this reason, the share of employers offering or planning to offer menopause benefits rose to 15% in 2023, up from just 4% in 2022.

Where are the gaps?

Gaps exist across all forms of women’s health, and the fertility and menopause markets are by no means saturated. Investing in women’s health goes far beyond reproductive health. There are many conditions that greatly impact women, but have limited diagnostics or therapeutics that currently exist. These gaps present numerous greenfields as the industry continues to scale.

Endometriosis

This incredibly painful condition is expected to affect more than 11% of women in the U.S. between the ages of 15 and 44. Despite its prevalence, it takes an average of 10 years for women in the U.S. to get a diagnosis. As a condition, endometriosis lacks sufficient diagnostic and therapeutic tools, and the pain women experience is often dismissed throughout their diagnosis journeys. It is one of the prime focuses of femtech unicorn Myovant Health. But endometriosis remains a largely misunderstood condition with debilitating consequences – representing a prime opportunity for SaaS startups.

Polycystic Ovarian Syndrome (PCOS)

PCOS affects as many as five million — or 12% — of American women. Those with PCOS can suffer from a wide variety of symptoms that require lifestyle management and, in some cases, medication to regulate hormonal balance and mitigate insulin resistance. The syndrome is also linked to other conditions – it increases the risk of Type 2 diabetes, heart disease, high blood pressure, sleep apnea, and stroke. Companies like Allara Health have emerged to help patients manage their PCOS through testing and personalized plans, given women who receive a PCOS diagnosis often have few resources to navigate this chronic condition and its implications.

Mental health and caregiving

According to the CDC, “Women who are caregivers are at greater risk for poor physical and mental health, including depression and anxiety.” Over 60% of caregivers in the U.S. are women, and at a baseline, mental health conditions already affect one in five women. While there is no shortage of startups in the mental and behavioral health space, there have yet to be any breakout companies centered around women’s unique journeys and multiple roles. The prevalence of mental health conditions in women paints a clear picture as to why innovators in the broader healthcare space must consider factors like sex, gender, and other social identities when aiming to improve outcomes.

The innovators

Menstrual cycle tracking

Clue and Flo are some of the most widely adopted women’s health products in the world. Fifty million women globally — and one in three women in the U.S. — use period trackers, which are designed to help users understand and monitor their menstrual and reproductive health. These apps provide useful, evidence-based content about periods, health, fertility, and sex. Natural Cycles offers period tracking functionality as well but differentiates in this market by serving as an FDA-cleared digital contraceptive for all women regardless of their cycle irregularity.

Pelvic pain support

Often used as an employer benefit, Hinge Health is a digital care program for those with chronic musculoskeletal conditions such as back or joint pain and offers sensor-guided exercise therapy, coaching, and education. While not aimed solely at women, their pelvic floor care PT program addresses a largely unmet need within the space. Insight led the Series B investment round, in partnership with Atomico.

Cancer detection and clinical trials

Screenpoint uses AI to detect and diagnose breast cancer in its early stages. Insight invested in Screenpoint’s Series C in 2021. Breast cancer screening guidelines continue to improve with new updates in 2023 proposing annual mammograms starting at the age of 40 versus 50, and at 25 for women considered at risk. Outside of breast cancer, improved diagnostics are needed across cancer types that affect women. Ovarian cancer detection startup, AOA hopes to reduce the mortality rate of this deadly gynecological cancer via early detection, given effective treatment does exist for cases in stages 1 and 2. Historically, women have been drastically under-represented in clinical trials, negatively impacting the long-term outcomes of approved drugs. Leal Health is a treatment decision support platform for cancer patients, matching patients with the right clinical trial for them, and in turn, helping pharma meet their diversity targets during recruitment.

Vaginal health

When it comes to holistic vaginal health, from basic gynecological infection testing and treatment to understanding the vaginal microbiome, there remains much work to be done. Evvy launched an at-home vaginal microbiome test and uses this data to provide better vaginal health care to women through their network of providers. Evvy also spearheaded Equal Research Day, dedicated to increasing awareness of the gaping holes that remain in women’s health research. Daye is similarly innovative, and after years of deep R&D, launched at-home STD and STI testing via tampons as well as a period pain clinic.

The considerations

Here are Insight’s key considerations for founders building a software business within the femtech space.

Value creation

A critical question femtech startups need to ask themselves is, “How do we solve key women’s health challenges while creating value for key stakeholders, namely payers?” Alignment between value creation for patients and value capture as a business is vital. While it’s tempting to go direct-to-consumer, and there is certainly a case to be made for this, it’s important that the cost of the next generation of innovation in women’s health is not paid solely out of women’s pockets.

Set out the vision

Success looks different for everyone. Building a unicorn is one archetype of success as a startup founder, and while more unicorns are great for the femtech market, the sector also needs to see exits at every stage. Additionally, companies in the space should have a defined vision as to which problems they hope to solve. Does the company become a women’s health platform with multiple applications and conditions addressed? Or should the focus remain on a particular challenge? Each has its merits and place in the industry.

Education is needed for all

While founders play an outsized role in educating the public about women’s health issues, investors in particular need to get educated and educate others. There might be a temptation to shy away from conditions that are not experienced personally or give into discomfort surrounding the topic of women’s health, but an unwillingness to learn will lead to missed opportunities. Normalizing conversations about health is critical, and it’s amazing how normal these conversations can be when we create space for them. Investing in women’s health improves outcomes for everyone — lower healthcare costs, higher workforce productivity, and higher quality of life.

The resources

Newsletters

- Femtech Insider – Founded by Kathrin Folkendt, Femtech Insider is one of the leading platforms for femtech and women’s health. The newsletter comes out every Thursday.

- FemTechnology Summit – Having started in 2021, the annual summit promises to bring together cutting-edge innovators to tackle women’s health pain points. The Substack newsletter explains all.

Podcasts

- Femtech Focus – Produced by FemHealth Insights and hosted by CEO Dr. Brittany Barreto, the FemTech Focus podcast engages people supporting, investing, and innovating in the FemHealth market to talk about present innovations and the future of women’s health and wellness.

- Beyond The Paper Gown – Created by Mitzi Krockover, MD, Beyond The Paper Gown discusses all things women’s health from the perspective of a provider and angel investor.

- Business of The V – Co-hosted by experienced women’s health operator Rachel Braun Scherl and Gynecologist Dr. Alyssa Dweck, this podcast speaks to leaders across the women’s health ecosystem.

Read

- McKinsey – The dawn of the femtech revolution

- McKinsey – Unlocking opportunities in women’s healthcare

- Dealbook – Guide to femtech

- Beauhurst (UK) – Femtech Companies Closing the Gender Health Gap

- Mewburn Ellis – Femtech: a growth industry

- SVB – Innovation in Women’s Health Report

- The Center for Intimacy Justice – Petition against Meta’s advertising discrimination

- Nature – Women’s health research lacks funding

- Halle Tecco – Your Guide to Starting a Women’s Health Company

- TechCrunch –Female Economy

- TechCrunch – Startups and physicians must unite to empower women’s health

Insight has invested in Gameto, AIVF, Hinge Health, Screenpoint, and Leal Health.